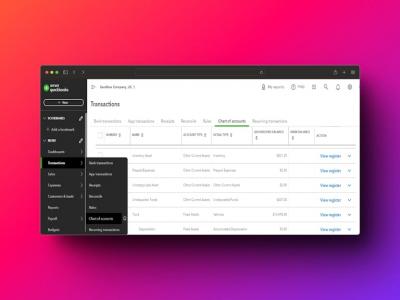

Efficient bookkeeping is essential for the success of any small business, and the Chart of Accounts (COA) in QuickBooks plays a crucial role in organizing your financial data. The COA is a complete list of all accounts used to record transactions, including income, expenses, assets, liabilities, and equity. Setting it up correctly ensures your financial reporting is accurate and easy to manage.In this guide, we’ll walk you through the steps to set up your Chart of Accounts in QuickBooks.What Is the Chart of Accounts?The Chart of Accounts is essentially the backbone of your financial system in QuickBooks. It categorizes every financial transaction so you can track your business performance with clarity.Income Accounts: Revenue streams from sales or services.Expense Accounts: Costs associated with running your business.Asset Accounts: Resources your business owns, like equipment or cash.Liability Accounts: Debts your business owes, such as loans.Equity Accounts: Owner’s investments and retained earnings.Steps to Set Up the Chart of Accounts in QuickBooks1. Log In to QuickBooksStart by logging into your QuickBooks account and navigating to the dashboard.2. Go to the Chart of Accounts SectionFrom the left-hand menu, select "Accounting" and then click on "Chart of Accounts."3. Add a New AccountClick the "New" button to create a new account. You’ll need to provide the following details:Account Type: Choose the appropriate category, such as income, expense, or asset.Detail Type: Select a specific subtype, like rent expense or bank account.Name: Give the account a clear and descriptive name.Description: Add any additional notes for clarity.4. Customize Accounts as NeededQuickBooks provides a default Chart of Accounts, but you can edit, delete, or add accounts to match your specific business needs.5. Save ChangesOnce all details are entered, click "Save and Close" to add the account to your COA.Tips for Setting Up the Chart of AccountsKeep It Simple: Avoid creating too many accounts; focus on those relevant to your business.Review Regularly: Update the COA periodically to reflect changes in your business.Use Subaccounts: Organize related accounts under a parent account for better tracking.Why the Chart of Accounts MattersA well-organized Chart of Accounts makes it easier to:Generate accurate financial reports, such as Profit and Loss or Balance Sheets.Track income and expenses for tax preparation.Gain insights into your business’s financial health.Learn MoreFor a step-by-step walkthrough and additional tips, check out our full blog post here: How to Set Up Chart of Accounts in QuickBooks.Final ThoughtsSetting up your Chart of Accounts in QuickBooks correctly can save you time and stress while providing a solid foundation for your business’s financial management. If you need help with bulk data management in QuickBooks, Transyncpro is here to support you every step of the way!

https://transyncpro.com/blog/charts-of-accounts-in-quickbooks